charitable gift annuity minimum age

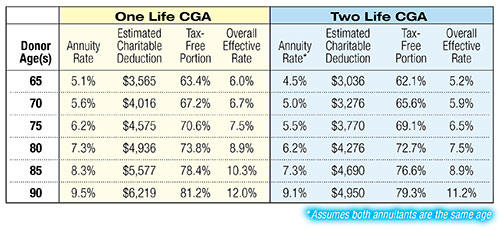

125 rows Rates for younger annuitants ages 5 to 50 were reduced as necessary to comply with the 10 minimum charitable deduction required under IRC Sec. Age Older Age Rate Younger Age Older Age Rate Younger.

Annuities The Catholic Foundation

SUGGESTED CHARITABLE GIFT ANNUITY RATES Approved by the American Council on Gift Annuities Effective April 26 2021.

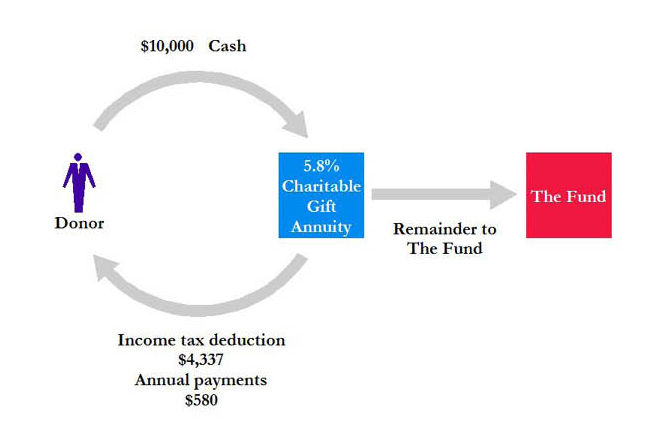

. The minimum gift amount is 50000. Charities must use the gift. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity.

The minimum required gift for a charitable gift annuity is 10000. The minimum age for an AACR Foundation gift annuity is 60. You love helping animals.

The amount of your payments is based. What if I have not reached 60 years of age but have an interest in establishing a. You must be 60-years-old to begin receiving.

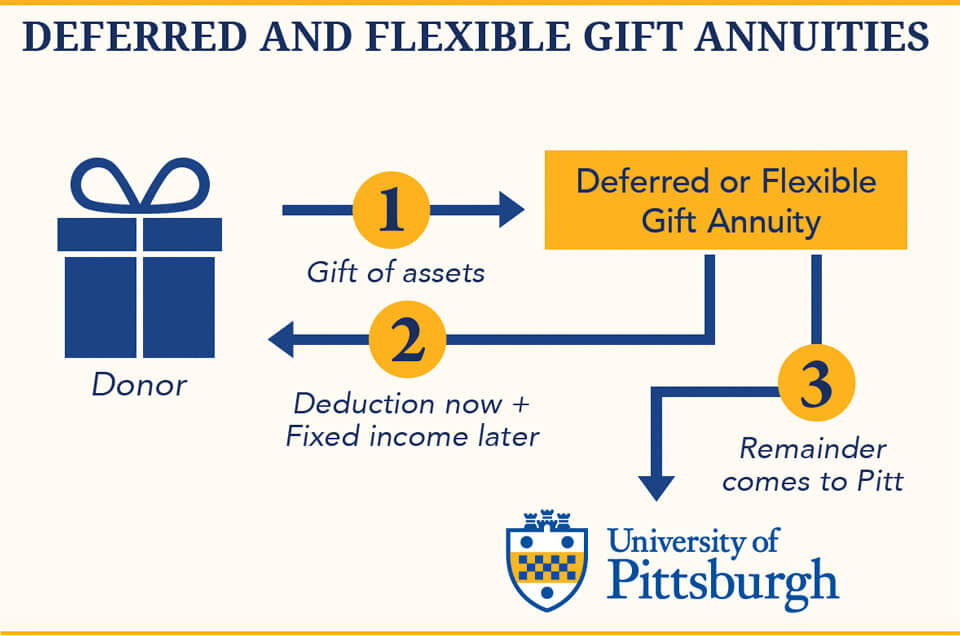

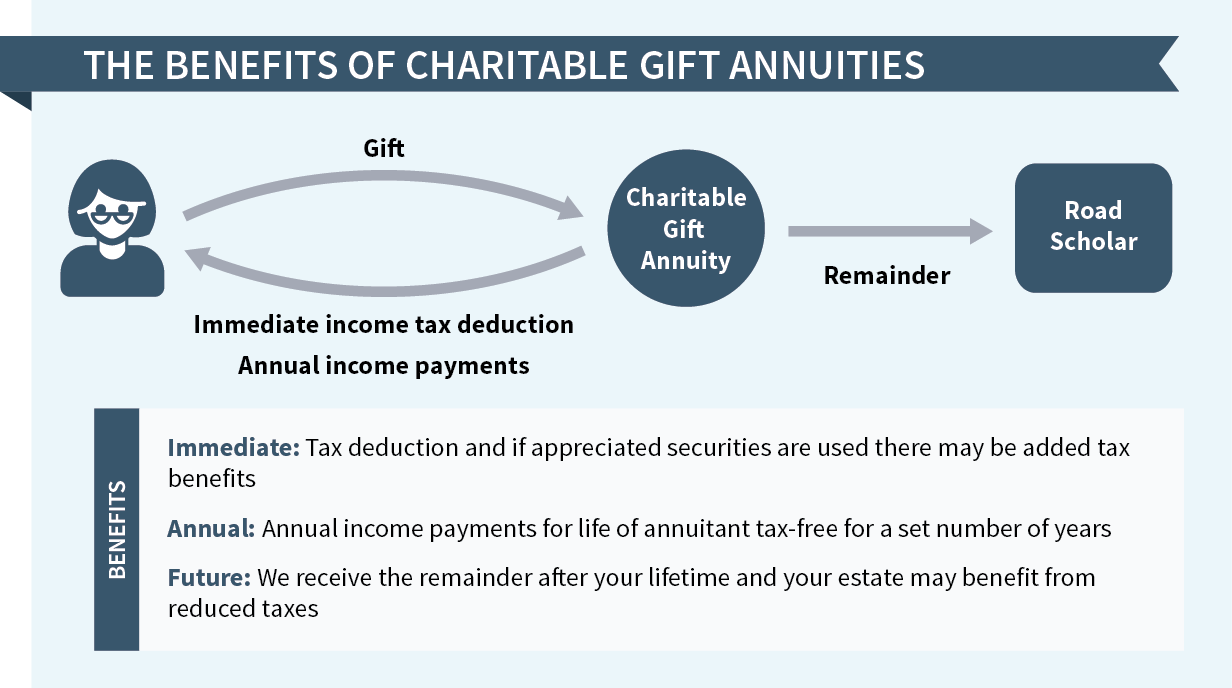

New Look At Your Financial Strategy. Gift annuities may be funded with cash or securities. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an.

Ad Support our mission while your HSUS charitable gift annuity earns you income. A charitable gift annuity is a contract between a charity and a donor bound by some terms explained below. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000.

What is the minimum age and amount required to establish a Charitable Gift Annuity with ChildFund and begin receiving payments. Charitable Gift Annuities are growing in popularity in todays low interest economy as a way to increase guaranteed lifetime income and benefit the church. Others require you to be at least 65 years old to start receiving payments.

This type of planned giving. Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. You love helping animals.

Judging by your age and when you gave the gift there is a fixed payout. Many charities require a minimum 10000 to 25000 initial donation to fund the annuity. Make your legacy one of compassion.

For these reasons CGAs are favored over CRUTs by donors who are looking for certainty in their periodic payments and who do not satisfy the current IRS-required beneficiary. Creating a charitable gift annuity. In exchange the charity assumes a legal obligation.

Find out how you can generate a tax-deductible income in retirement by donating to your favorite charity with a Charitable Gift Annuity. Charitable gift annuitants must be at least 60 years old before they are eligible to receive payments. Find a Dedicated Financial Advisor Now.

Visit The Official Edward Jones Site. Do Your Investments Align with Your Goals. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

Ad Support our mission while your HSUS charitable gift annuity earns you income. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. The minimum gift is 10000 and the minimum age when payments may begin is 55.

Most gift annuity donors are. Make your legacy one of compassion. Including your ages when you set up the charitable gift annuity.

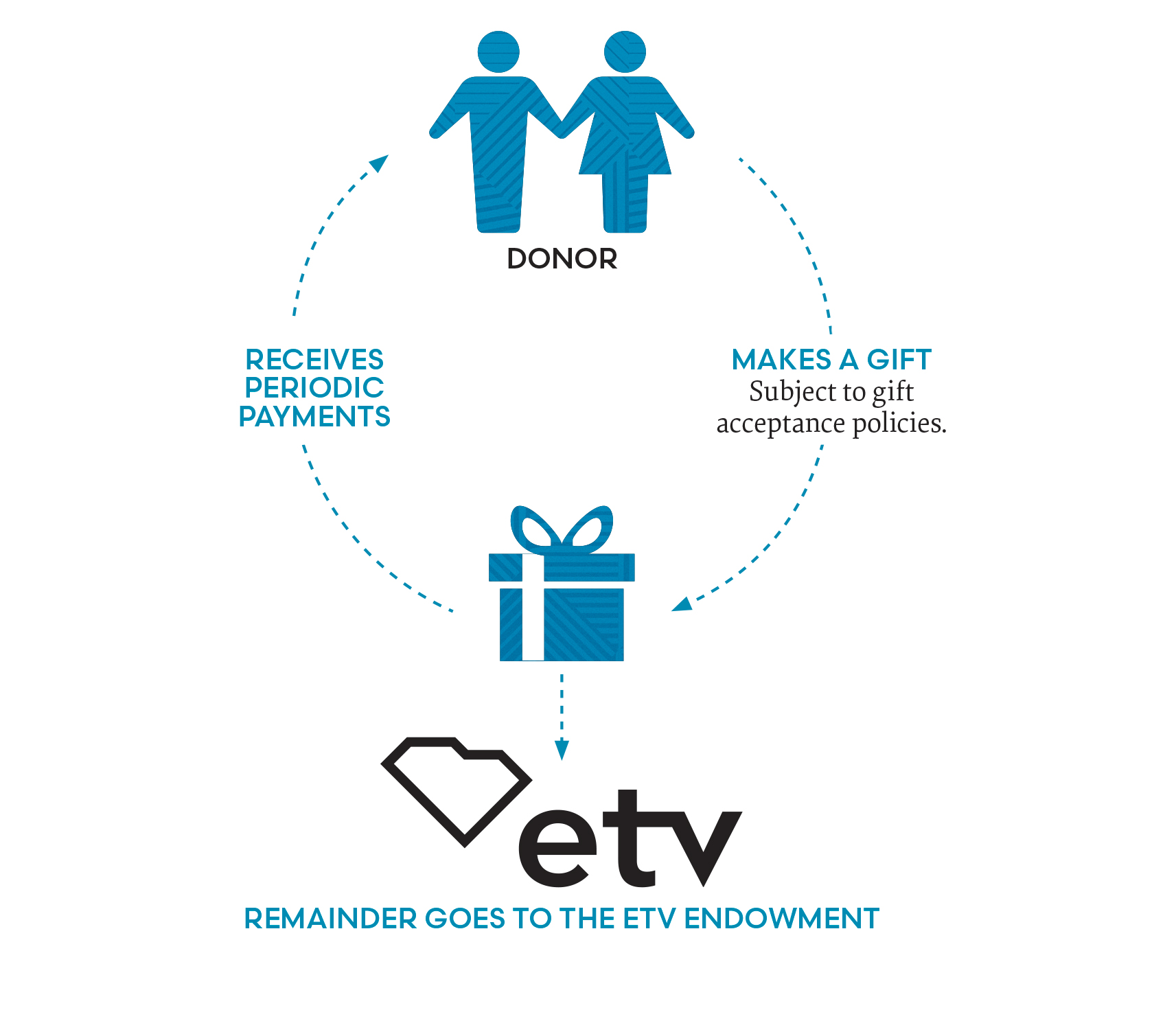

Charitable Gift Annuity Etv Endowment Of South Carolina

City Of Hope Planned Giving Annuity

Charitable Gift Annuities Uses Selling Regulations

City Of Hope Planned Giving Annuity

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center

Charitable Gift Annuities The University Of Pittsburgh

Annuity Annuity Life Insurance Marketing Marketing Humor

Rising Rates On Charitable Gift Annuities The Institute For Creation Research

Charitable Gift Annuity Rate Increases Texas A M Foundation

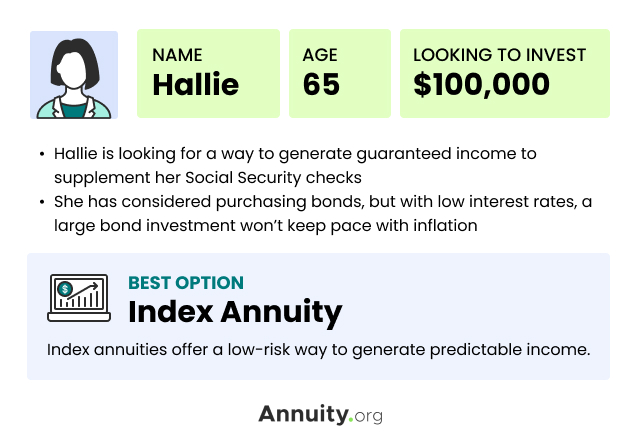

Indexed Annuity Pros Cons Fixed Index Equity Index

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuities Road Scholar

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities Development Alumni Relations

Acga Charitable Gift Annuity Rates

8 Introduction To Charitable Gift Annuities Part 1 Of 3 Planned Giving Design Center